Nothing compares to having a place you can call home. You now have control over your place and no longer have to worry about paying rent. Owning a home gives you the freedom to design and renovate it however you choose, anytime you want.

Everyone wants to own a home at some point, which is a great achievement. However, some believe that renting is better because you don't have to invest much money, while others say saving money to buy a home seems impossible. In this article, will discuss a few things you can do to get into the right mindset and save for your future house.

The first thing you can do is track your budget. You'll have trouble saving money if you don't know where your money goes monthly.

These days, you can now track your costs and income without creating a spreadsheet or using a piece of paper to scribble everything down, thanks to a ton of free budgeting applications you can download. Using a money-savings app, you can now quickly put your monthly income and spending. Doing this will give you an accurate view of how much money you are making and how much you should save.

Here are some of the free budgeting apps you can use:

Remember that monitoring your accounts will help you to determine where your money is going. Also, knowing your budget is crucial when purchasing your first house.

Achieving your savings objectives can help you become financially independent. Because of this, defining and envisioning goals for yourself will motivate you to put in more effort to achieve them.

You might start by laying down your financial objectives, but make sure to keep them attainable and practical. Your short-term and long-term goals can be divided into two categories once your strategy is in writing. Doing so will enable you to be more specific and determine where to begin saving first.

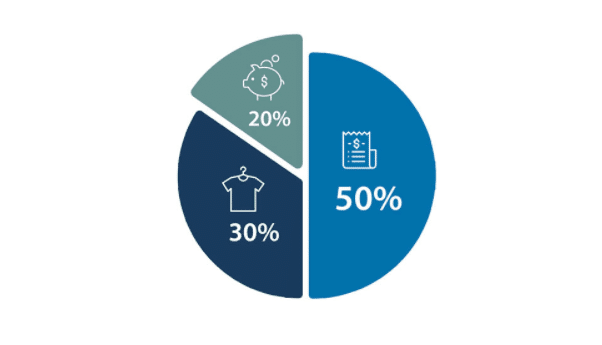

Use the 50-30-20 budgeting technique, for instance. You can keep track of your expenditures with this straightforward technique. The following is how the budgeting approach can be used:

Is it necessary to get a new phone while your old one is still functional? It's fantastic to have a new phone, but if you want to save money, you should wait.

Remember that deciding your financial priorities will help you understand your wants and needs. For example, "want" is something you like, but you can live without it. On the other hand, "need" is something you can't live without, like a house or food.

Many people consider their wants a need, but having that kind of mindset is not good. So to maximize your spending, the best way is to look at your monthly savings and understand what you want to achieve.

To enhance your saving goals, you can start by cutting down or downgrading things and services you are using. Identify non-essential stuff you can spend less, like entertainment or eating outside. You can also try turning off lights and appliances that you don't need in the meantime.

Another way to help you start saving is to look for ways to earn money on the side. Aside from your job, you can look for other gigs that fit your schedule, so your savings can increase.

For example, you can start selling stuff you don't need, rent out your car, and help your friends or family's business with your technical skills, marketing skills, photography skills, communication skills, etc. It doesn't mean you have to do all these, but doing side hustle jobs can help you earn extra money.

It's exciting to watch your savings grow as you finally start your journey of saving for your future house. But do not forget to monitor how your savings grow from when you started. Check your monthly progress and see if you are on track with your saving goals. If you feel like something is not right, identify it quickly and fix the problem.

Owning your own house can be an uphill battle- especially when you're strapped for cash. However, if you don't give up and keep looking for interesting ways to save money, you'll find a way out of any tough spot in no time at all!

Remember that a "Goal without a plan is just a wish." If there's one thing that will hold you back from getting into your own home, it's not having a specific or practical plan for getting there! Be realistic and make progress every day towards achieving your dream.